How to Begin Debt Reduction

Do you have large credit card bills, are trying to make minimum payments, and are living paycheck to paycheck?

You’re not on your own. Millions of people in the United States are in the same boat. The American Psychological Association estimates that 72 percent of Americans are worried about money. Twenty-two percent of them are in a lot of pain.

If credit card debt is causing you stress, now is a good time to consider how you may reduce your stress by selecting the best debt relief option and recovering financial control.

Statistics demonstrate that the quantity of debt held by the average American correlates with their peak earning years. The more money you make, the more debt you’ll likely accumulate.

The following are the most popular types of consumer debt in the United States, as seen in the graph below:

- Home mortgages

- Auto loans

- Student loans

- Credit card debt

- Medical bills

(Source: Survey of Consumer Finances of the Federal Reserve.)

How can people get into and stay in major debt?

People overspend for a variety of reasons, and it’s worth noting that impulse purchasing isn’t necessarily one of them.

-

-

Since the economic downturn of 2007-2009, the rising cost of living has wrecked havoc on American household finances. Over the previous decade, the rise in the cost of living has surpassed the rise in incomes by a large margin.

-

Overspending is a common outcome of financial hardship. People who are stressed about money are more prone to incur additional unneeded expenses than those who are not.

-

Credit card debt grows as a result of paying for essentials that are not covered by household income.

-

Keeping track of your finances during a period of unemployment contributes to your credit card debt.

-

Travel expenses, whether for business or pleasure, frequently surpass American families’ budgeted budgets.

-

Your disposable income is also impacted by unexpected medical costs.

-

Non-medical situations might also lead to overspending.

-

Once you’ve accumulated a significant amount of debt, procrastination may become your worst enemy. Debt accumulation can be discouraging, sapping your energy and willingness to take the required efforts to get out of debt.

Putting off financial problems will not improve your condition; rather, it will limit the amount of solutions available to you. No matter your age or financial condition, you can overcome your debt if you start today. The good news is that you don’t have to go it alone in your quest for financial independence.

The Most Difficult Part is Getting Started.

It can be difficult to get started on debt relief.

To properly begin resolving your debt, you must do the following steps:

-

- Examine your current financial status.

- Inform yourself about the true cost of your debt.

- Determine the source of your problems.

- Make a list of your debts and prioritize them. Secured debts, such as your home and auto loans, should be at the top of your priority list.

- Establish a budgeting system and a spending strategy.

- Make sure you’ve cut your debts in half or stopped taking on new ones.

You Have the Ability to Get Out of Debt. Yes

you can get a customized debt relief plan right now..

Start Addressing Your Debt

The first question you must answer is, “Do I require professional assistance to get my finances in order?” Some folks who aren’t in a lot of debt are able to solve their difficulties on their own. They may require some budgeting and cost monitoring assistance, but they may not require the services of a debt recovery professional.

Ask yourself these questions to determine if you require professional debt relief assistance.

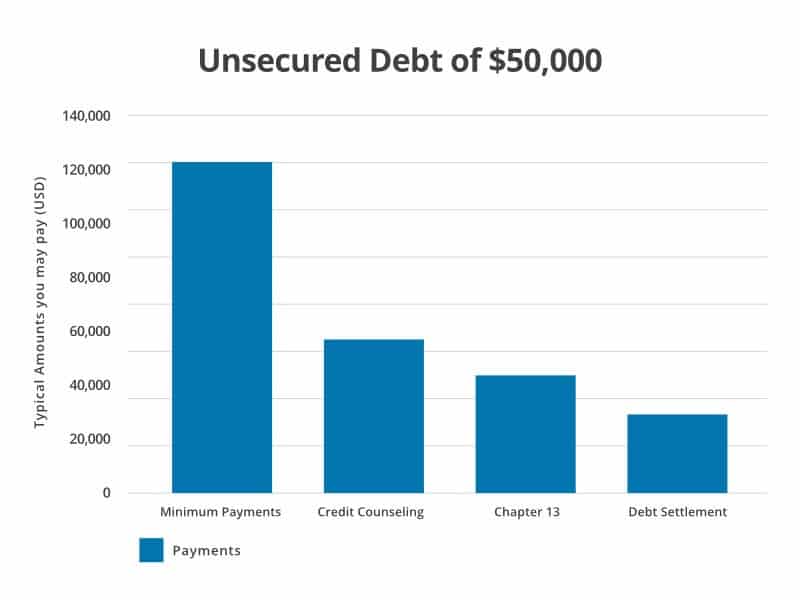

A look at the chart below shows how much a person with $50,000 in unsecured debt can save by opting for debt settlement versus alternative options like paying only minimum payments on credit cards, attending credit counseling, or filing bankruptcy.

(Briesch, Richard. (2009). Economic Factors and the Debt Management Industry.)

Cardinal Law Center Advantage Can Help

Thousands of people have benefited from Cardinal Law Center Advantage. We know how to reclaim control over your debt and your financial independence.

We can assist you by providing a practical debt-relief plan. A Cardinal Law Center Advantage debt settlement plan will help you pay off your debt in a timely manner while keeping the things that are important to you.

If you’ve previously taken steps to get out of debt on your own, we can evaluate what you’re doing well and what you need to alter. Our Certified Debt Specialists may create a customized plan for you and lay out all of your options.

How Does Cardinal Law Center Help?

A Cardinal Law Center Certified Debt Specialist can work with your creditors to gain you repayment concessions, allowing you to pay less than you owe and get out of debt faster.

You are not walking away from your debts by using debt resolution. Rather, you’re working out a deal with your creditors to settle your debt for a lower sum than you owe. A creditor is usually prepared to do this since they understand that someone in financial distress has options such as bankruptcy, which could result in the creditor receiving nothing at all.

Unsecured debt, such as credit card debt, medical debt, and personal loans, can be settled through debt reduction solutions.

Debt settlement may have a negative influence on your credit score, but it is much less severe than the consequences of declaring bankruptcy.

The debt relief process at Cardinal Law Center begins with a free 20-minute consultation with a Certified Debt Specialist at 888-254-3702. The expert prepares a personalized relief strategy for you, answers all of your questions, and clearly explains the plan to you.

This service is provided free of charge by Cardinal Law Center. We only get paid if you pay off your debts and save money.

It is possible to get out of debt, and we can assist you in doing so with a realistic, feasible plan. Call Cardinal Law Center at 888-254-3702 for a customised debt reduction plan and take the first step toward financial freedom now. Cardinal Law Center can create a customized debt relief strategy for you.

Related Pages

Debt settlement can save you money and, if the benefits and drawbacks are weighed, it may be the best option for some debtors. See if it’s a good fit for you.

You have a variety of debt-resolution choices depending on your financial position. Clear One Advantage can assist you in determining which choice is best for you.

Do you find yourself drowning in credit card debt? Explore how Debt Settlement can help you get back in control of your credit cards.

Are you interested in learning the truth about debt settlement? In this post, we address a few common misconceptions about credit card debt settlement.

Begin Your Personalized Debt Relief Plan Right Now!

I appreciate all of your assistance in resolving my debt, and I've been speaking Cardinal Law Center's praises since the beginning. You guys have gone above and above my expectations, and I've already referred you to a few others I know. Thank you very much for everything!